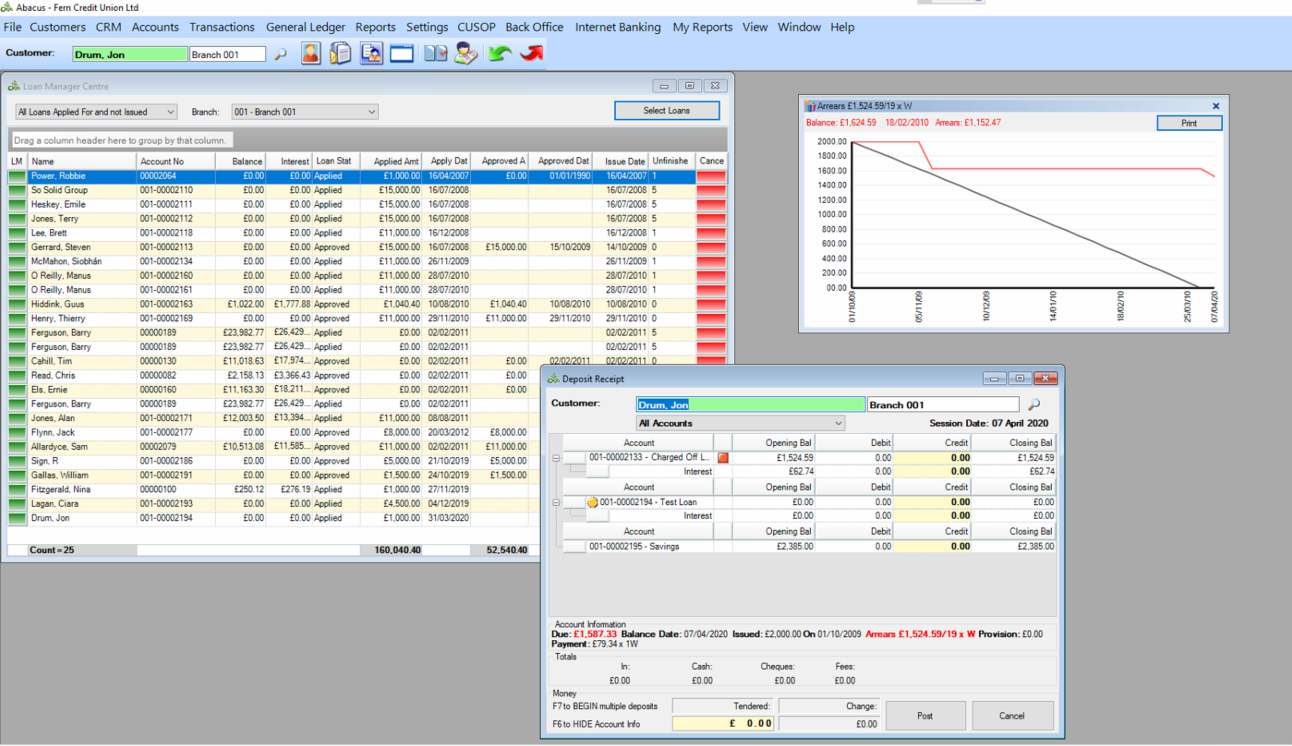

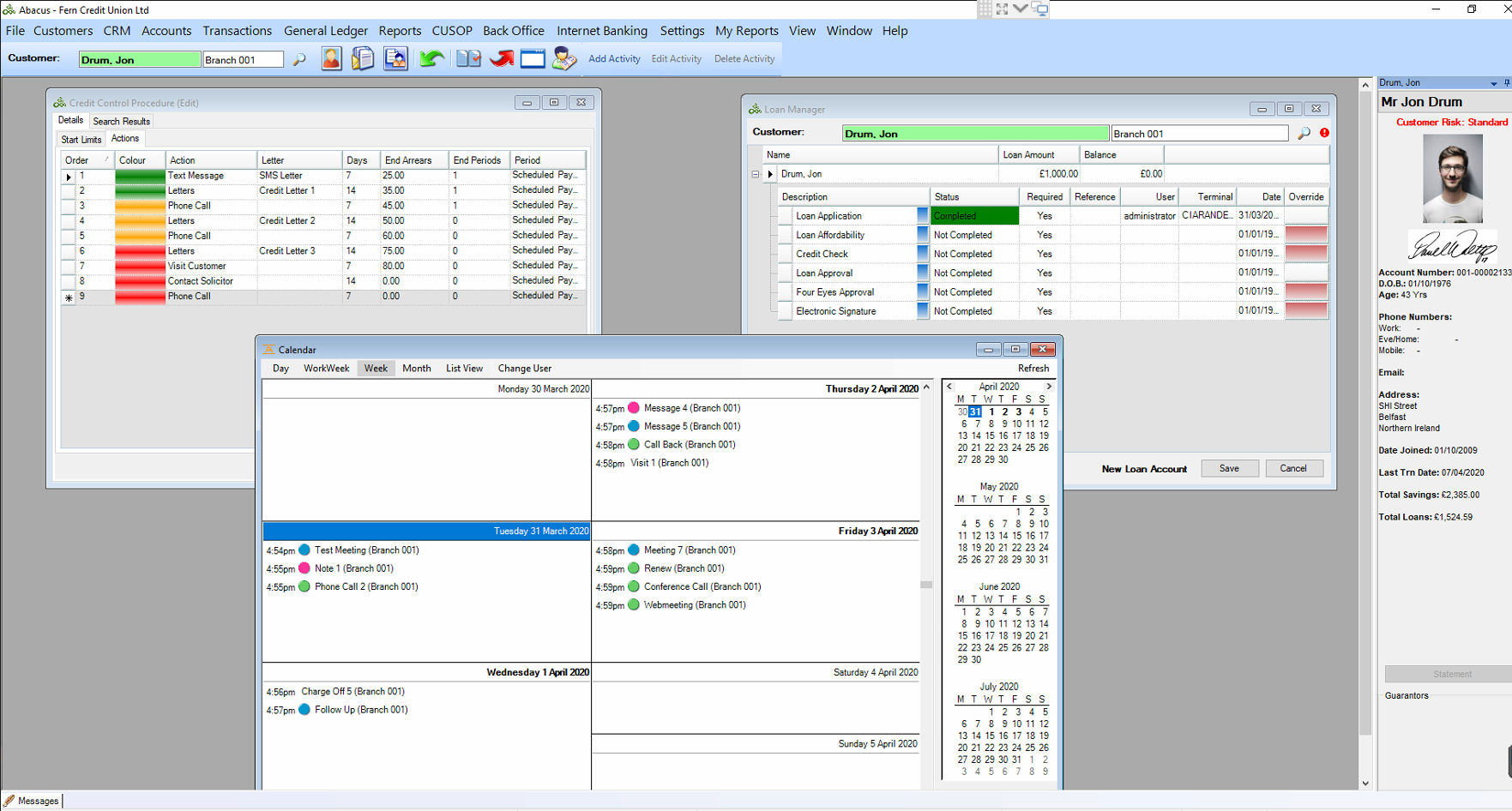

Abacus provides a solution to financial institutions that is both comprehensive and easy-to-use. Abacus offers a cost effective, modern, fully integrated and scalable solution that will not only meet current operational requirements, but also the challenges of advancing technology, market development and product offerings.

Fully multi-lingual design with no additional programming

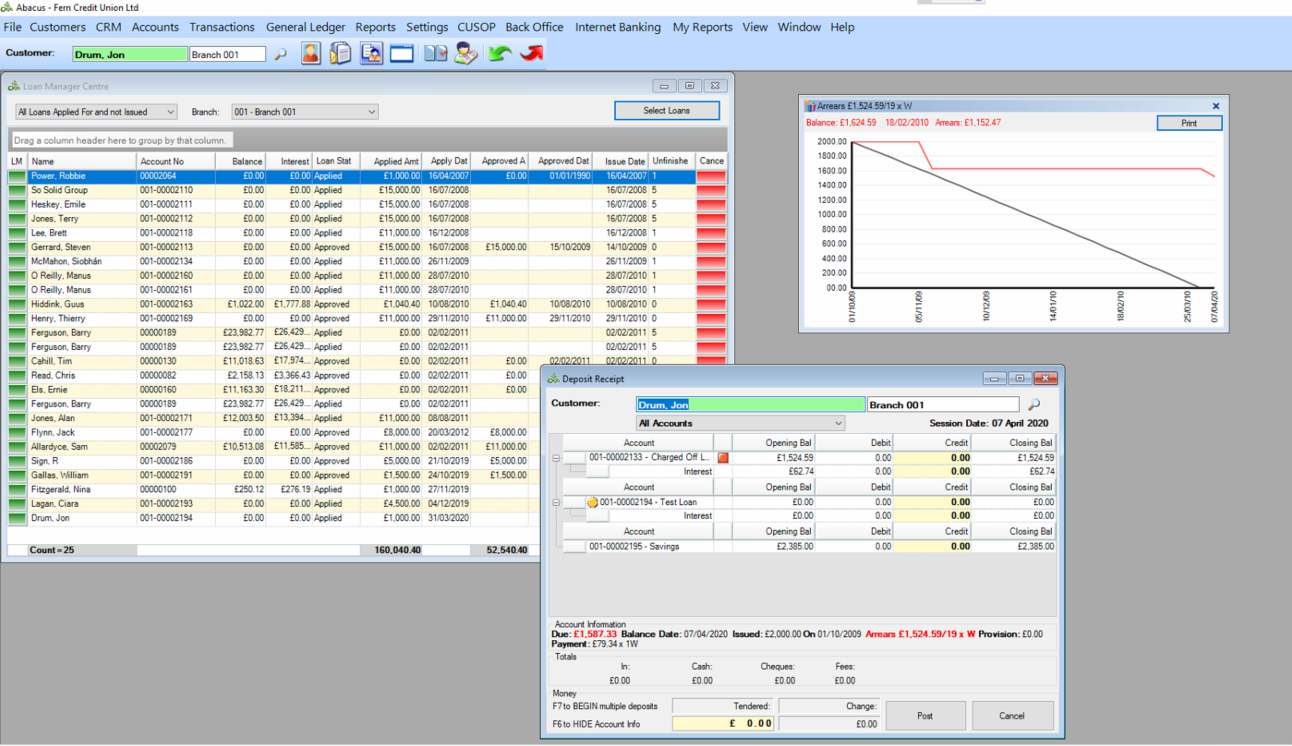

Comprehensive client-centric customer management

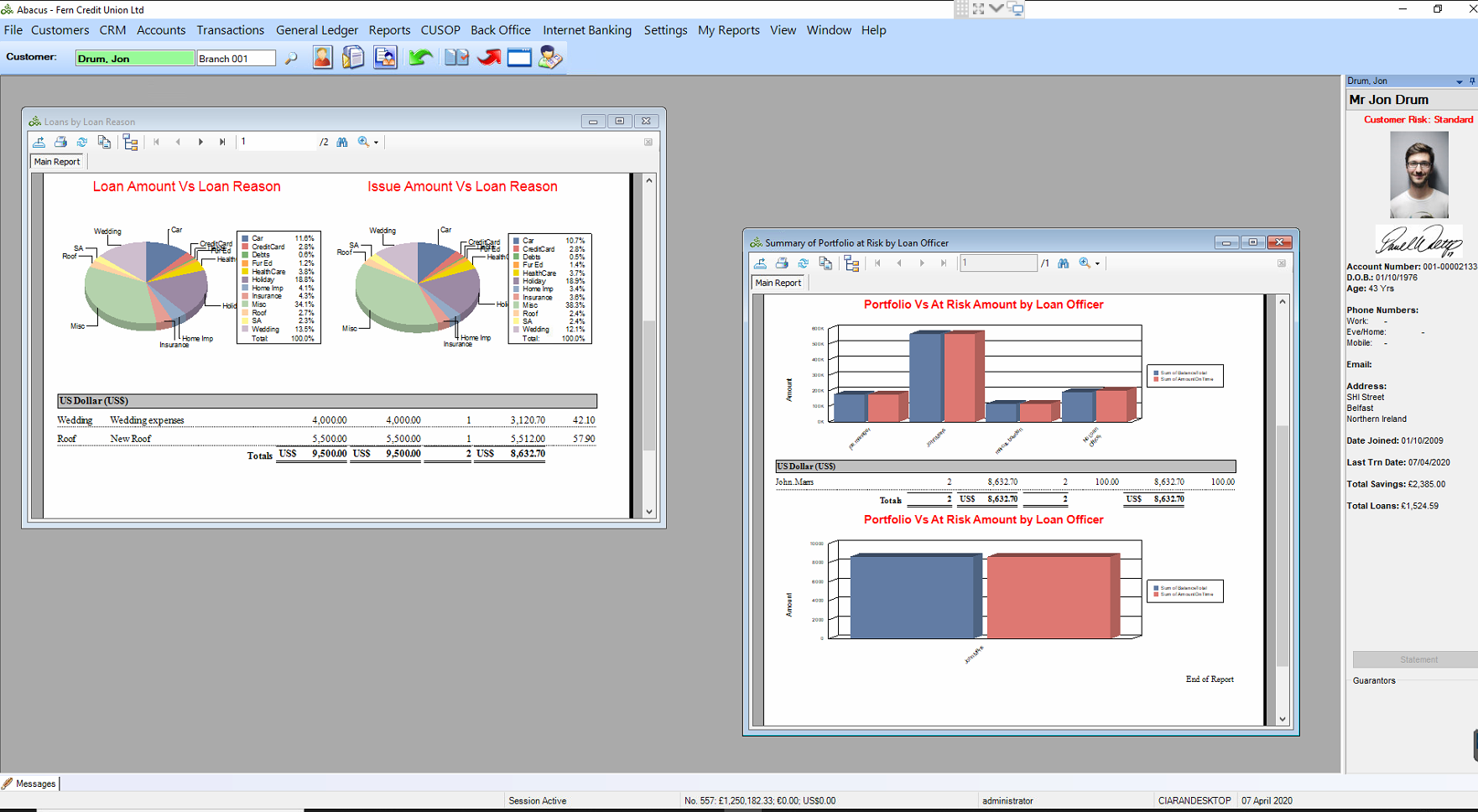

Over 100 inbuilt reports and fully integrated BizNet financial management reporting

Extensive and powerful user security and encryption features

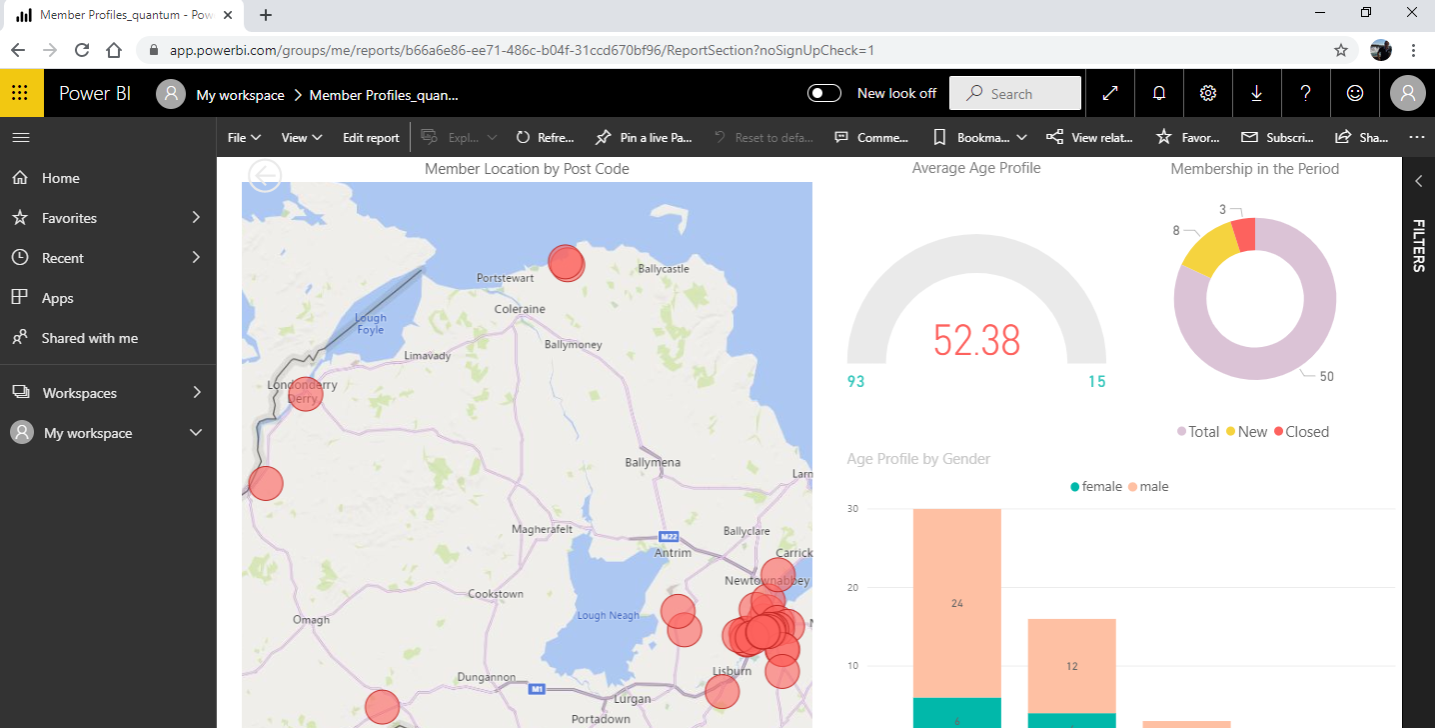

Work anywhere, anytime with our suite of omnichannel solutions

Take the tour

Discover how Abacus and our suite of omnichannel Solutions can help your financial institution.

Industry proven

Our most powerful software is used around the world by financial institutions just like yours.

Financial intelligence

Benefit from years of development including third-party integrations and financial CRM.

Abacus has been independently evaluated by Accenture

"...its functionality and ease of use enables you to respond quickly to changing market needs without expensive customisation."

Functionality

4

/4

BEST

Ease of use

4

/4

BEST

Reporting

3

/4

EXCELLENT

Services

3

/4

EXCELLENT

Technical Capabilities

4

/4

BEST

In August 2019, an Independent US consultant undertook a 3 week evaluation of Abacus, versus local competition.

With Abacus coming top in the review, this is where the rest came short:

| Abacus | Competition | |

|---|---|---|

| Multi-branch general ledger | ||

| Integrated credit checking services | ||

| Easy to create new lending products | ||

| Flexible repayment schedules | ||

| Visual reports, dashboards and analytics | ||

| Online documentation and training videos | ||

| Open APIs for integration | ||

| Notifications by email and SMS | ||

| Cloud hosted | ||

| Remote and mobile access | ||

| Automated daily backup |

| Abacus | Competition | |

|---|---|---|

| Multi-branch general ledger | ||

| Integrated credit checking services | ||

| Easy to create new lending products | ||

| Flexible repayment schedules | ||

| Visual reports, dashboards and analytics | ||

| Online documentation and training videos | ||

| Open APIs for integration | ||

| Notifications by email and SMS | ||

| Cloud hosted | ||

| Remote and mobile access | ||

| Automated daily backup |

Customers like you

Abacus is used by a diverse range of financial institutions, find out who is using it today.

OXUS

OXUS Network seeks to provide its clients in developing countries with adapted and competitive financial services while offering its investors attractive financial returns.

Crossmaglen Credit Union

Crossmaglen provides non-profit loans, savings and insurance products. They use Abacus to service their customers in-branch and remotely using online banking powered by the Abacus API.

SCVO Credit Union

SCVO's Credit Union is Scotland's leading voluntary sector Credit Union. They offer low cost loans, savings facilities and quick bank transfers, providing an easy, ethical way to borrow money.

Get in touch with us

Let's set up a time to discuss how we can help you.

Enabling agile community banking

Abacus has a wide range of product definition parameters built-in that can be combined in many different ways to enable you to tailor a product that responds to your customers' needs.

Fully multilingual user interface

Abacus has been designed to be fully multi-lingual, and support double-byte characters and right-to-left scripts. Abacus data entry screens are available in English, Spanish, French, Indonesian, Russian and Arabic.

Business intelligence at your fingertips

Abacus has real-time integration capabilities with a market-leading Management Reporting tool that enables reports to be designed directly from within Excel, using inbuilt links to Abacus data.